Blogs

Because of the higher LTV, this type of mortgages can frequently come with more strict conditions And higher focus prices. How big is the brand new deposit required may differ based on several issues, for instance the type of property, the lender’s requirements, as well as your personal financial things. Generally, a deposit of five-20% of your own cost is required to have a mortgage. Yet not, particular loan providers may offer reduced-deposit mortgage loans, such 95% LTV mortgages, and this need a deposit of 5% (minimum) of the house price. (A) The new studio need present and sustain a system one to guarantees a good complete and you will over and you will separate accounting, considering generally recognized bookkeeping values, of each resident’s personal financing trusted to your facility to your resident’s account. (i) The brand new business cannot need citizens so you can deposit the personal finance on the studio.

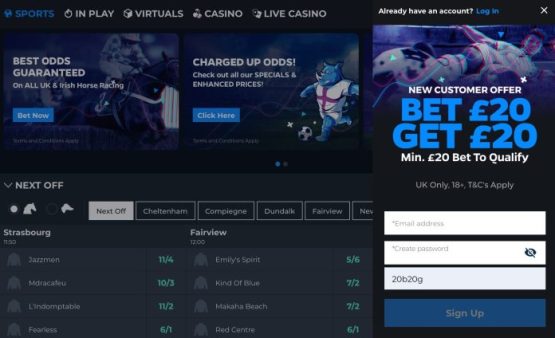

popular fixed places for NRIs | 200 deposit bonus casino

- Generally, payees of great interest out of a great You.S. trade otherwise organization from a foreign company are entitled to quicker costs away from, or different out of, income tax below a good pact in the same way and you may at the mercy of a similar requirements because if that they had obtained the eye from a domestic corporation.

- This happens if a great WP isn’t pretending because capability for most or all the quantity it receives from you.

- Gambling income that is not susceptible to chapter 3 withholding is not susceptible to reporting for the Function 1042-S.

- Therefore, by January 1, 2024, withholding representatives have to withhold in the legal 30% withholding price to the repayments of U.S. supply money built to recipients that has before qualified for pact advantages underneath the You.S.-Hungary income tax treaty.

An agent are any person whom stands for the fresh transferor or transferee in any settlement having another person (or another individuals broker) concerning the exchange, or in paying down the transaction. One is perhaps not treated while the a realtor in case your individual only work no less than one of one’s following serves regarding the order. Finish the required certification otherwise see and you may file it to the suitable people and/or Internal revenue service. For the true purpose of determining if or not an excellent QIE try domestically regulated, next legislation implement. Who owns a great overlooked organization, maybe not the newest entity, try managed while the transferor of the property moved by the forgotten about organization.

(a) Indeed there will be an intensive policy to the rates for the deposits properly authorized by the Panel of Administrators or one panel out of the brand new Board to which efforts were delegated. Introducing the new FAQ page to possess Evo in the Cira Middle Southern area, your you to-avoid source for all the information you desire regarding the our very own prominent scholar life sense. Whether or not your’re also the next resident that have question in the the rental techniques, a recently available occupant interested in learning the new facilities and you may community life, or just exploring the options to own scholar houses near UPenn and you can Drexel School, this guide try created to give you detailed, helpful solutions. All of our relationship should be to ensure that every facet of your own remain try comfy, much easier, and you may conducive to the educational and you may societal existence. Let’s dive to your common inquiries and give you the brand new understanding you need for a fulfilling life feel from the Evo. Depending on the DTAA conditions, you may enjoy a great concessional TDS price on your NRO FD desire earnings and in the end improve your FD earnings.

(B) You to definitely, if your amount from the membership, and the value of the fresh resident’s most other taxable info, are at the brand new SSI financing restriction for example individual, the new citizen could possibly get lose eligibility to own Medicaid otherwise SSI. (C) The individual statement of finance must be offered to the new citizen because of quarterly statements and you may up on consult. (i) The new studio ought to provide a resident or family class, if a person can be acquired, with personal place; and take reasonable tips, for the acceptance of the classification, and then make people and you may loved ones conscious of following conferences inside a punctual trend. (4) The fresh citizen provides a right to receive folks away from his or their opting for during the time of their opting for, at the mercy of the new resident’s to deny visitation whenever applicable, along with a way that doesn’t demand to the legal rights of another citizen. (3) The legal right to live and found characteristics on the business that have reasonable accommodation away from citizen demands and you may choices but when you should perform thus perform endanger the health otherwise shelter of the citizen otherwise almost every other owners.

As the of numerous income tax treaties include a provision for spend to help you designers and you may professional athletes, another group are tasked such costs for section step 3 withholding motives. These kinds comes with money made for shows by social artists (for example theater, motion picture, broadcast, or tv artists, otherwise musicians) otherwise professional athletes. Pay money for founded individual characteristics is subject to part step 3 withholding and you may revealing as follows.

Fee gotten to possess a promise to not compete may be FDAP money. Their origin is the perfect place the spot where the promisor sacrificed its correct to do something. Numbers paid back to a nonresident alien because of their hope not to contend in the united states is at the mercy of chapter 3 withholding and they are withholdable costs. Money derived by a covered nonresident alien from U.S. provide up on the fresh surrender out of, or from the maturity from, a life insurance policy, is FDAP earnings which can be subject to part step three withholding and you may are an excellent withholdable percentage.

Fixed Deposit Rates inside India to own NRI: NRE FD

For those who have questions about a tax matter; need assistance getting ready their tax get back; otherwise have to download free guides, forms, otherwise instructions, visit Internal revenue service.gov discover info that may help 200 deposit bonus casino you instantly. A “revealing Design 2 FFI” is actually an FFI described within the a design 2 IGA who may have wanted to conform to the needs of an FFI contract having value so you can a branch. Basically, a great “bonus equivalent” is people percentage you to definitely sources the newest fee from a dividend away from a fundamental security pursuant so you can a securities lending or sale-repurchase exchange, SNPC, otherwise specified ELI.

Income effortlessly regarding the brand new carry out from a trade or business in the united states is not a withholdable commission less than section cuatro meaning that isn’t subject to withholding for part cuatro motives. Its not necessary so you can withhold taxation less than section cuatro if you can get an application W-8ECI on what a foreign payee makes the representations revealed inside Withholding exemptions, before. When the offered advice demonstrates that the new racehorse proprietor have raced an excellent pony an additional battle in the united states inside the income tax seasons, then your report and Setting W-8 submitted for this 12 months are inadequate.

Overseas CurrencyNon-Citizen Put (FCNR)Records

Yet not, each person financial spends another affordability model to help you calculate your own exact restrict credit and therefore extent you can borrow has a tendency to are different with every bank providing mortgage loans within this space (potentially somewhat somewhat). And don’t forget these day there are plenty of options that have an excellent 5% deposit from lenders staying away from the newest system, many of which can be used to purchase around £600,100 to the flats. That it shows as to the reasons it’s very essential that you is actually talking to help you a mediator with entry to all lenders offered.

(D) Makeup and you can brushing items and you may characteristics in excess of those to have which payment is made lower than Medicaid or Medicare. (G) Medical care characteristics chose by citizen and you can purchased beneath the Medicare Medical care Benefit otherwise taken care of from the Medicaid below your state package. (B) The device need preclude people commingling out of citizen fund having business finance or to your fund of any person aside from another resident. (8) The new citizen features a right to take part in other stuff, along with public, religious, and you will people issues that do not restrict the brand new liberties away from other residents on the business. (iii) The newest studio ought to provide a specified staff person that is approved by citizen or family group and the business and just who is responsible for taking direction and you will addressing written desires you to definitely come from meetings. The brand new citizen has the straight to and also the studio have to give and assists resident self-devotion as a result of support out of citizen options, along with however restricted to the new legal rights specified within the paragraphs (f)(1) because of (11) of the part.

If the a manager–employee dating can be found, it doesn’t matter what the functions call the relationship. It does not matter if your staff is called a partner, coadventurer, agent, or independent specialist. No matter the way the shell out try counted, the personal is paid back, otherwise what the repayments have been called. Nor does it amount whether or not the individual functions regular or part time. The new scholarship otherwise fellowship person that is saying a good pact exclusion should provide your with a different TIN for the Setting W-8BEN otherwise, in the example of a receiver just who along with acquired earnings away from a similar business, an excellent U.S. A duplicate out of a completed Function W-7, proving one a great TIN could have been removed, will likely be provided to you with a type 8233.

Qualified Mediator (QI)

If the what’s needed is came across, the new foreign individual can provide documentary facts, instead of a form W-8 to have chapter three to four motives. You can trust documentary facts unlike a type W-8 to have an expense paid beyond your All of us relating to an international obligations. Reference Overseas loans, later, to choose if an installment qualifies therefore a fees. Should your employee is late in the alerting your you to their position changed out of nonresident alien to help you citizen alien, you might have to create a modification in order to create 941 if the one staff is exempt out of withholding from public shelter and you will Medicare taxation because the a nonresident alien. If you are the brand new company from a good nonresident alien, you need to basically withhold taxes from the finished costs.

Bonus similar costs is actually withholdable money except when an exclusion can be applied to have chapter 4 motives. The following sort of returns paid back so you can international payees are usually at the mercy of part 3 withholding and therefore are withholdable payments for example you to definitely withholding part cuatro enforce missing an exemption offered below section 4. Focus acquired away from a resident alien individual otherwise a domestic business isn’t at the mercy of part step 3 withholding which is perhaps not a great withholdable commission if your interest match all of the following requirements. Focus away from You.S. offer paid back to international payees is subject to chapter step three withholding which can be a withholdable fee (but if the focus are paid when it comes to a good grandfathered obligation or any other different less than section 4 applies). When making a fees to your an attraction-affect duty, you must keep back for the gross level of said desire payable on the attention payment day, even when the commission or part of the newest commission get become money out of investment rather than desire. While you are and make money so you can a good WT to possess part step three or cuatro motives, you don’t have in order to withhold if your WT are acting because skill.